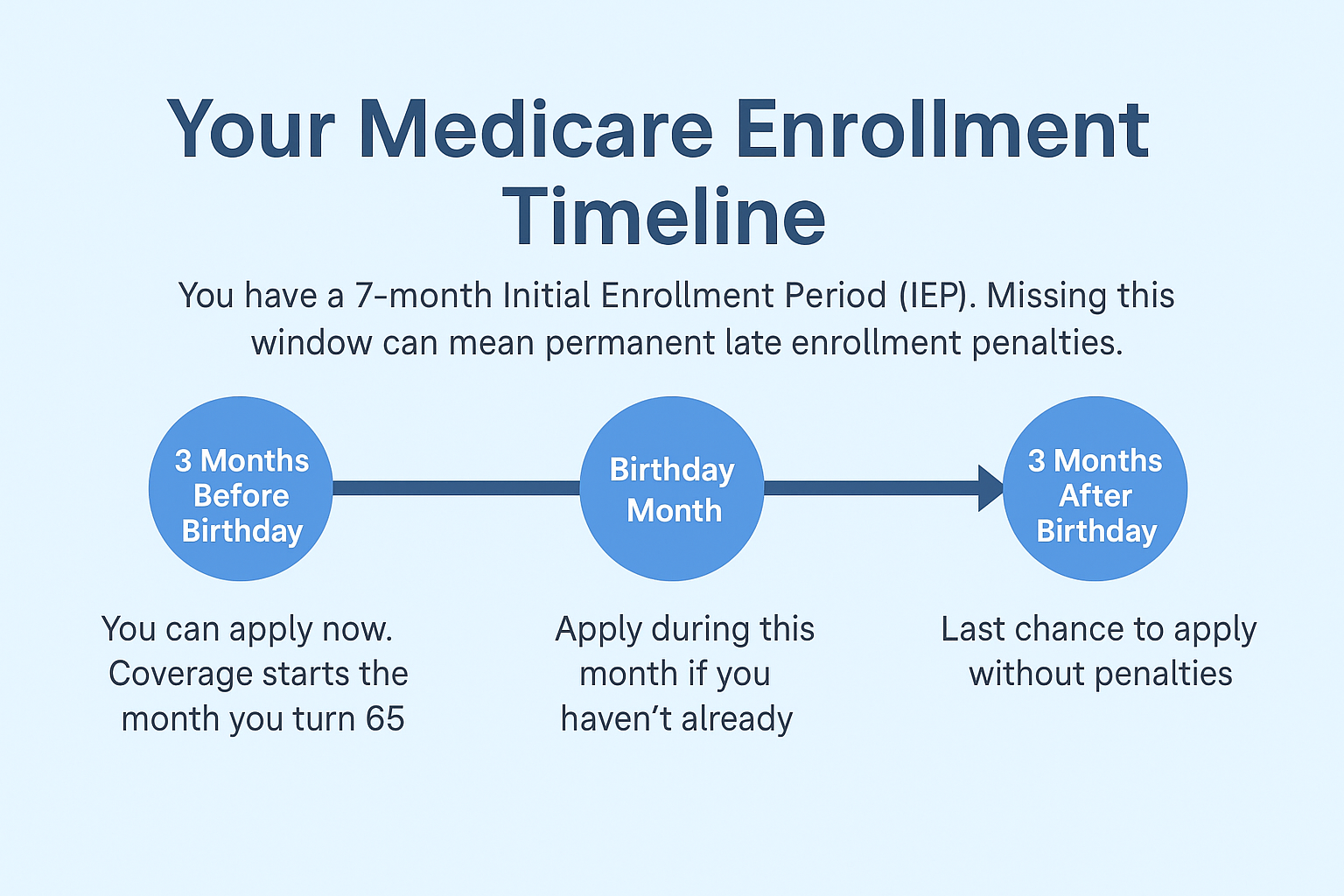

Turning 65? Here’s Your Medicare Enrollment Timeline

You have a total of 7 months to sign up for Medicare:

-

3 Months Before Your Birthday: You can apply now. Coverage begins the month you turn 65.

-

Your Birthday Month: You can still apply if you haven’t already.

-

3 Months After Your Birthday: Your last chance to apply without penalties.

Call (855) 428-0974 if you have any questions.

Common Questions About Medicare Enrollment

What happens if I miss the deadline?

If you don’t enroll during your 7-month Initial Enrollment Period, you may have to wait until the General Enrollment Period — and pay a late enrollment penalty that can last for life.

👉 Don’t risk extra costs — our advisors can help you enroll on time.

What’s the difference between Medicare Advantage and Medicare Supplement?

Medicare Advantage (Part C) bundles your coverage and may include extras like vision or dental. Medicare Supplement (Medigap) helps pay out-of-pocket costs not covered by Parts A and B.

👉 Healthcare Marketplace Advisors can walk you through the pros and cons based on your budget and health needs.

Do I need both Part A and Part B?

Most people sign up for both. Part A generally covers hospital care, while Part B covers doctor visits and outpatient services. If you’re still working or have other coverage, you may not need both right away.

👉 Talking with Healthcare Marketplace Advisors helps ensure you choose the right path for your needs.

What if I'm still working and have employer insurance?

If you have coverage through your employer, you may be able to delay enrolling in Part B without penalty. The rules depend on the size of your employer and your specific situation.

👉 Healthcare Marketplace Advisors can review your options so you don’t pay for coverage you don’t need.

Does Medicare cost money?

Part A is usually premium-free if you or your spouse worked long enough. Part B always has a monthly premium. Additional coverage (Advantage, Supplement, or Part D for prescriptions) comes with its own costs.

👉 We’ll help you understand what you’ll pay so there are no surprises.

What kind of penalties could I face if I delay Medicare?

If you miss your Initial Enrollment Period, you could pay a late enrollment penalty that lasts for life. For example, Part B penalties increase your monthly premium by 10% for every 12 months you delay enrollment without other qualifying coverage. Prescription drug coverage (Part D) has its own penalty as well.

👉 Talking with Healthcare Marketplace Advisors ensures you don’t miss important deadlines or pay more than you should.

Don’t Miss Your Enrollment Window

Your Medicare enrollment period is limited. Missing it can mean higher costs for life. Take the next step now — it only takes a few minutes.